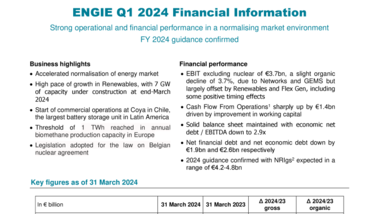

- Strong operational and financial performance in a normalising market environment

- FY 2024 guidance confirmed

|

Business highlights |

Financial performance |

|

|

Catherine MacGregor, CEO, said : ”ENGIE has made an excellent start to 2024 with EBIT excluding nuclear of €3.7bn, almost at the previous year’s level despite the market context of lower prices and volatility. This robust performance reflects, once again, the strength of our integrated model as well as our capacity to adapt to a rapidly-moving market environment. Over the first quarter, we continued to roll out our strategic plan with 7 GW of renewables capacity under construction, putting us well on track towards maintaining our pace of 4 GW of annual additional capacity up to 2025. We have reinforced our European footprint in biomethane, and we have started commercial operation of the largest battery storage unit in Latin America. We confidently reiterate our guidance for the full year 2024. The energy transition is well and truly underway, and ENGIE is determined to contribute to it every day, convinced that it can be affordable and desirable.”

1 Cash Flow From Operations = Free Cash Flow before maintenance capex and nuclear phase-out expenses

2 Net Recurring Income, group share

Contacts

ENGIE Press

+33 (0)1 44 22 24 35

engiepress@engie.com

Investors Relations Contact

+33 (0)1 44 22 66 29

ir@engie.com